santa clara property tax due date

The payment for these bills must be received in our office or paid online by August 31. Monday Aug 15 2022 534 PM PST.

The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm.

. Business Property Statements are due April 1. January 25 2021 at 1200 PM SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due February 1 and becomes delinquent at 5 pm. Due date for filing statements for business personal property aircraft and boats.

Send us an Email. A 10 penalty is added as of 500 pm. On Monday April 11 2022.

Last Payment accepted at 445 pm Phone Hours. January Treasurer-Tax Collector mails delinquent notices for any unpaid first. MondayFriday 900 am400 pm.

Enter Property Address this is not your billing address. A 10 percent penalty and a 20 cost will be added to unpaid balances. MondayFriday 800 am 500 pm.

December 10 First installment of secured taxes payment deadline. Enter Property Parcel Number APN. SANTA CLARA COUNTY CALIF.

When not received the county assessors office should be contacted. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time. The due date to file via mail e-filing or SDR remains the same.

On Monday April 12 2021. Second installment of secured taxes due. 12345678 123-45-678 123-45-678-00 Department of Tax and Collections.

Failed delivery of a tax levy wont negate late filing penalty or interest charges. If the due date on the bill falls on Saturday Sunday or a County holiday payments must be made the next business day to avoid penalties. If you are considering taking up residence there or just planning to invest in the countys property youll come to know whether Santa Clara County property tax rules work for you or youd rather search for a different location.

Closed on County Holidays. Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April. April 1 2021 at 1200 PM SANTA CLARA COUNTY CALIF The Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2020-2021 property taxes becomes delinquent if not paid by 5 pm.

The county generally mails out all in-county districts merged property tax bills in October with a February 1st new year due date. Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners. Before bills officially become delinquent and incur a 10 penalty plus a 20 cost to the.

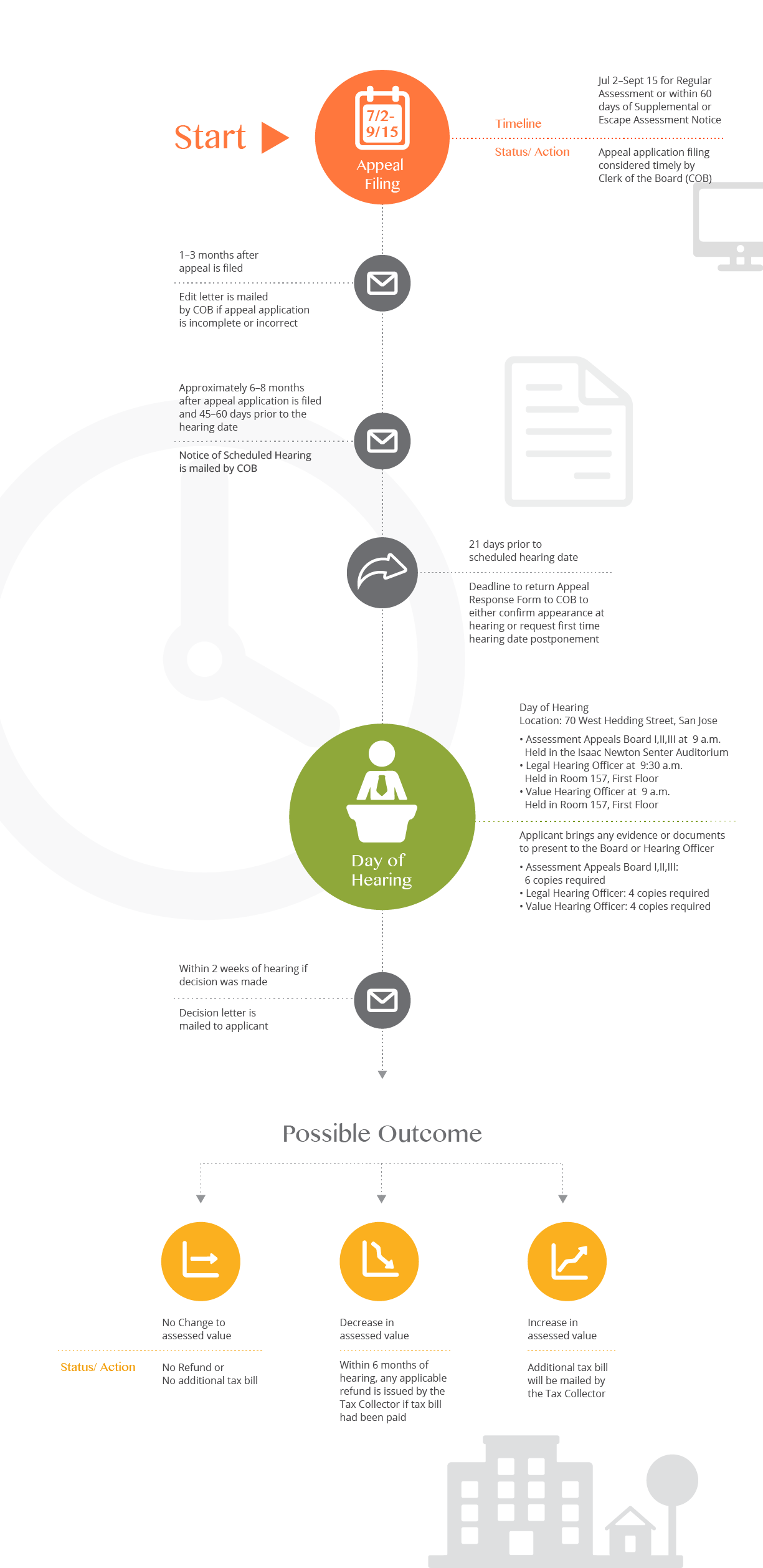

Property owners wishing to appeal a regular assessment to the Assessment Appeals Board may do so between July 2nd and September 15th. Unsecured bills mailed out throughout the year are due on the date shown on the payment coupon. October 19 2020 at 1200 PM SANTA CLARA COUNTY CALIF The County of Santa Claras Department of Tax and Collections has mailed out the 2020-2021 property tax bills to all property owners at the address shown on the tax roll.

November 1 First installment of secured taxes is due and payable. This date is not expected to change due to COVID-19 however assistance is. The Department of Tax and Collections in California had sent a reminder that taxpayers have until Monday April 11 2022 at 5 pm.

Treasurer-Tax Collector mails out original secured property tax bills. Deadline to file all exemption claims. When Are Property Taxes Due in Santa Clara.

On Monday April 12 2021. The first installment of the property tax payment is due on Monday November 2 2020. With this resource you will learn useful facts about Santa Clara County property taxes and get a better understanding of what to consider when it is time to pay.

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M

Property Tax Payment Instructions Department Of Tax And Collections County Of Santa Clara

Budget At A Glance City Of Cupertino Ca

California Property Taxes Explained Big Block Realty

Assessment Appeal Process Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara